Reports

Romanian Private Equity and Venture Capital Study 2024

Romanian Private Equity and Venture Capital Study 2024

We are happy to present the Romanian Private Equity and Venture Capital study for 2024, which highlights the developments and opportunities in the Romanian market.

Romania’s private equity market continues to be full of potential and continuous development. In 2024, following a modest 2023, private equity and venture capital activity in Romania regained momentum, offering tangible signs of recovery — though not yet of full acceleration.

The starting point of such analyses is the data provided by Invest Europe, one of the largest global associations of Private Equity and Venture Capital, as well as publicly available data about the Romanian Venture Capital environment from How to Web. These deals sustain the potential that we see in the Romanian market to develop local and regional players.

Romania Gender Diversity 2025

Romania Gender Diversity 2025

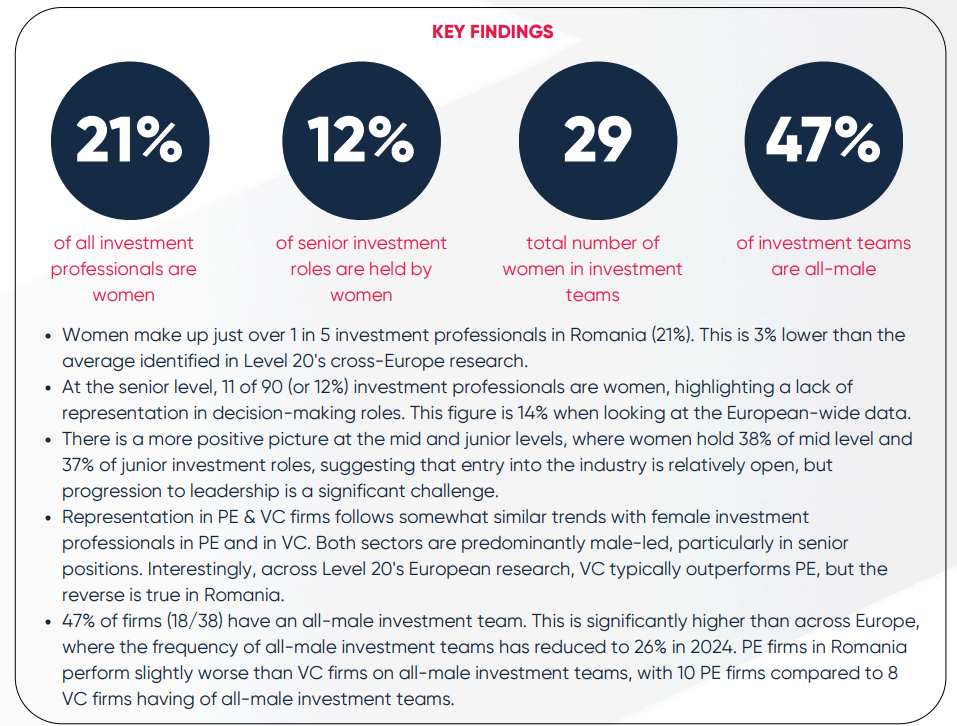

Level 20 CEE – Romania and the Romanian Private Equity Association (ROPEA) launch the 2025 Gender Diversity in Private Equity and Venture Capital in Romania report – the first study dedicated to the representation of women in Romania’s PE and VC industry.

This fact sheet report provides a baseline for tracking gender diversity and identifying areas for further analysis and industry engagement.

Romanian Private Equity and Venture Capital Study

We are happy to present the Romanian Private Equity and Venture Capital study covering 2022 and 2023, which highlights the developments and opportunities in the Romanian market.

The starting point of such analyses is the data provided by Invest Europe, one of the largest global associations of Private Equity and Venture Capital, as well as publicly available data about the Romanian Venture Capital environment from How to Web. These deals sustain the potential that we see in the Romanian market to develop local and regional players.

The regional Private Equity ecosystem is in a good position to help the growth of small and medium local players to the next level, while the local Private Equity and Venture Capital funds are focused mostly on growing the smaller tickets in the market. We are convinced that more diversified financing sources can only help and support the further development of the local Private Equity and Venture Capital market, combined with the expectation that in the next periods ESG will have a more prominent role in the investment process.

2022 Central & Eastern Europe PRIVATE EQUITY STATISTICS

This report was compiled with the help of Invest Europe’s Central and Eastern Europe Task Force. It provides annual activity statistics for the private equity and venture capital markets of Central and Eastern Europe (CEE) in 2022 and prior years.

The statistics contained herein are based solely on the “market approach”, wherein information is compiled to show activity in a particular country, regardless of the origin or location of private equity fund managers. This contrasts with the “industry approach” that shows the activity of fund managers based in a particular country, and which is not applied in this paper Invest Europe believes using the market approach gives a more accurate picture of the overall investment trends and activities in the markets of CEE due to the significant activity of regional funds and fund managers.

For the purposes of this publication, CEE comprises the countries of Bosnia and Herzegovina, Bulgaria, Croatia, the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Moldova, Montenegro, North Macedonia, Poland, Romania, Serbia, Slovakia, Slovenia and Ukraine. These countries had a total population of about 151.5 million and registered a total GDP of €2.1 trillion in 2022.

Romanian Private Equity and Venture

Capital Study

Romanian private equity and venture capital market development

Welcome to the 2021 and first half of 2022

Activity Report of the

Romanian Private Equity

& Venture Capital study, produced

by Deloitte in Association with Romanian Private Equity Association

(ROPEA)

We are happy to present the Romanian Private Equity and Venture Capital study covering 2021 and the first half of 2022, which highlights the developments and opportunities in the Romanian market.

The starting point of such analyses is the data provided by Invest Europe, one of the largest global associations of private equity and venture capital, as well as publicly available data about the Romanian Venture Capital environment from How to Web. We draw the attention to the fact that, although part of the Private Equity transactions in 2021 and the first half of 2022 were not included in the Invest Europe data, these transactions are flagged and considered in the report (such the acquisition of the Romanian assets of CEZ by Macquarie Infrastructure and Real Assets estimated at €1bn and the investment of Novalpina Capital in MaxBet estimated at €250m).

Such deals are a clear proof of the potential that we see in the Romanian market to develop significant local and regional players. Additionally, we see that the regional Private Equity ecosystem is in a good position to help the growth of several small and medium local players to the next level, while the local Private Equity and Venture Capital funds are focused mostly on growing the smaller tickets in the market.

We are convinced that more diversified financing sources can only help and support the further development of the local Private Equity and Venture Capital market, combined with the expectation that in the next periods ESG will have a more prominent role in the investment process.

We thank ROPEA for all the help and support provided, as well as to the ROPEA members for the useful insights and contributions in making this report possible.

2021 Central and Eastern Europe Private Equity Statistics

The 18th annual edition of the Central and Eastern Europe Private Equity Statistics, produced in partnership with Gide Loyrette Nouel, delves into countries across CEE to show the spread of private equity and venture capital activity, as well as development of regional powerhouses.

Invest Europe 2021 Central and Eastern Europe Private Equite Statistics

Invest Europe Private Equity Activity Data Report (2021)

Investing in Europe Research: Statistics on Fundraising, Investments, & Divestments.

Invest Europe - Activity Data Report 2021

Private Equity in CEE: Creating value & continued growth

Report

Private Equity in CEE: Creating Value and Continued Growth’ is an in-depth study of private equity’s role in innovation and economic development across Central and Eastern Europe.

The report, whose work was led by Invest Europe’s CEE Taskforce, investigates the ongoing convergence of CEE countries with other EU regions and the investment trends that have enabled private equity to be a positive force in the region’s progress. It also highlights the industry’s role in innovation and raising ESG standards. These themes are brought to life through detailed case studies of companies backed and fully exited by private equity investors during 2015-2019.

Webinar

On February 11, Invest Europe hosted a dynamic, online panel discussion among senior industry participants on the CEE region’s dynamic growth potential and opportunities for investors, highlighting recent, successful investment stories (2015 – 2019).